Company’s life cycle and Product life cycle financing in Energy Technologies 🔄

import Image from 'next/image'

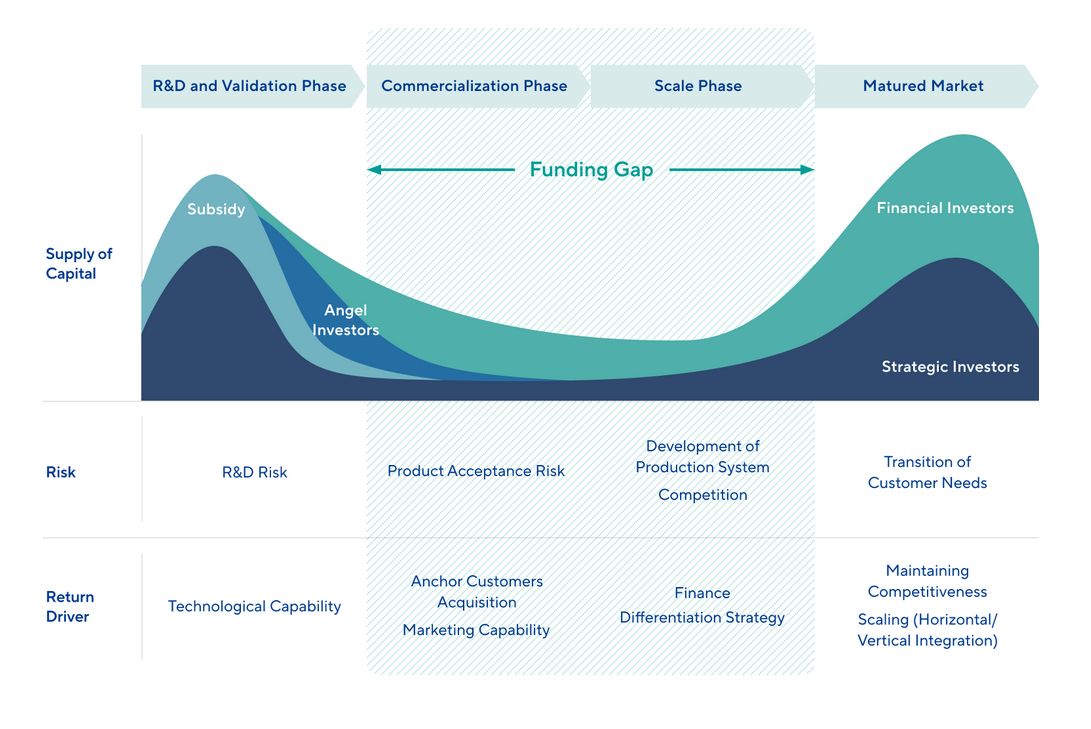

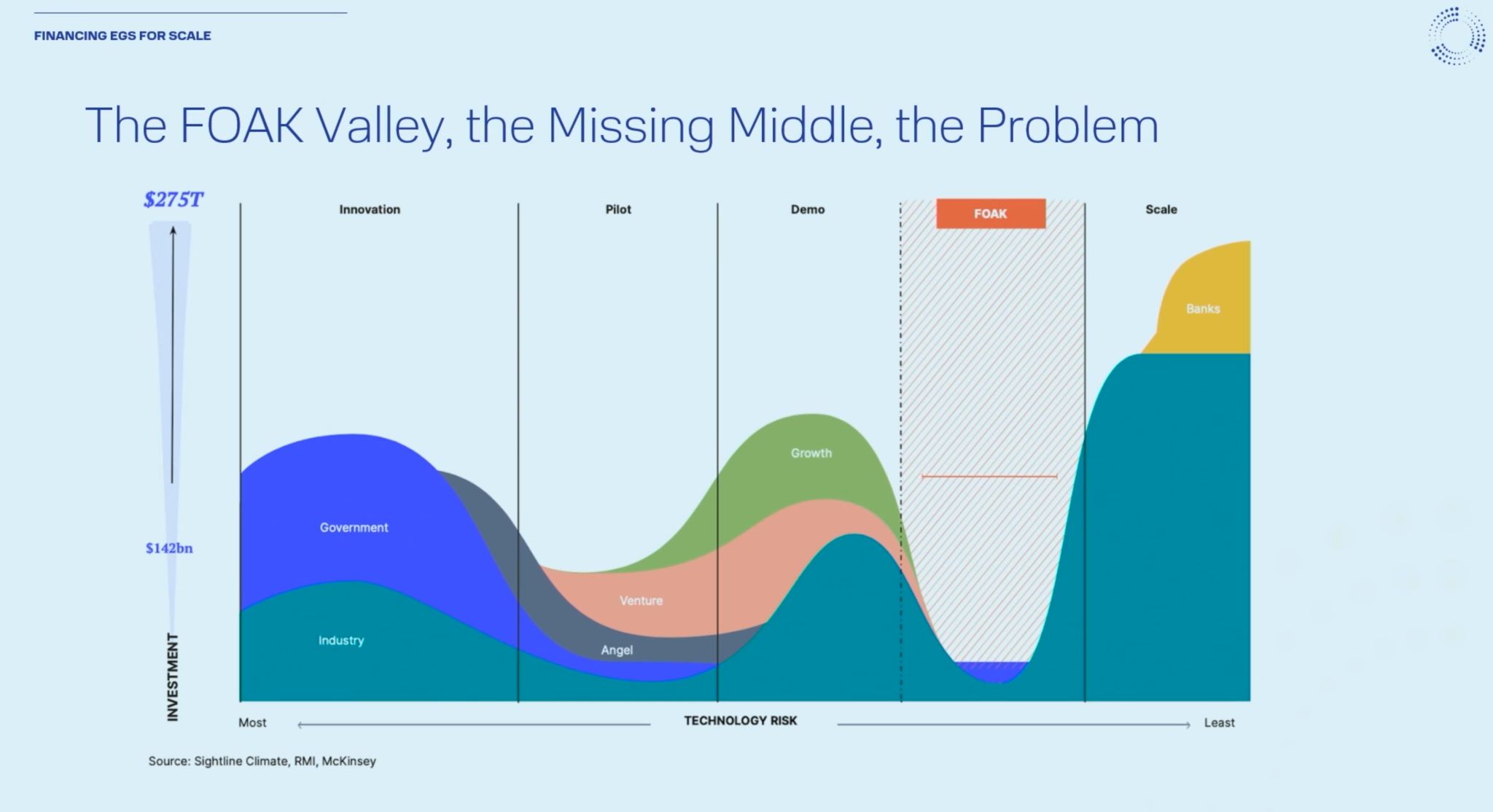

Infrastructure investors and energy technology companies agree on a mid range gap in financing. Believe it or not, it is mostly after the pilot and validation stages, as companies move toward their first commercial deployment.

🔬 Stage 1: Research. Grants and government subsidies cover most funding necessary. During pilot phase strategic investors (industry experts), venture capitals and even business angels jump in.

⚓ Stage 2: first commercial deployment growth capital, key on the real demand side is the anchoring customer for the first commercial project. Already there is significant capital needed, at reasonable cost with patience.

🏗️ Stage 3: Scale. Capital needed to finance projects until delivery to a broader customer base or income-generating agreements start.

While this seems to be a global phenomenon, the following graphs shared are from a Japanese investor and from a US consultancy 🌍 Looking closely at the case I know best: Europe pushes forward much research with massive grants for companies and public funding for universities, and with fewer ventures and growth --> the challenge is right after the pilot.

I share with you 2 graphs that explain the different kind of capital access.

- By company stage. Marunouchi Innovation Partners

- By product stage. Sightline Climate (CTVC) - Mckinsey, shared by Fervo Energy.

Currently, I am applying these frameworks to help a clean-tech startup navigate the First of a kind Valley, securing the specific financing needed for its first commercial project. Looking ahead, I am focused on helping energy technology companies find the industrial-scale anchoring customers to prove their commercial viability.